In the rapidly evolving world of Islamic fintech, BitSukuk by DIGITAS stands at the intersection of tradition and technology — digitizing Sukuk issuance through blockchain, automation, and Shariah governance. The result is a transparent, efficient, and inclusive ecosystem where ethical finance meets decentralized innovation.

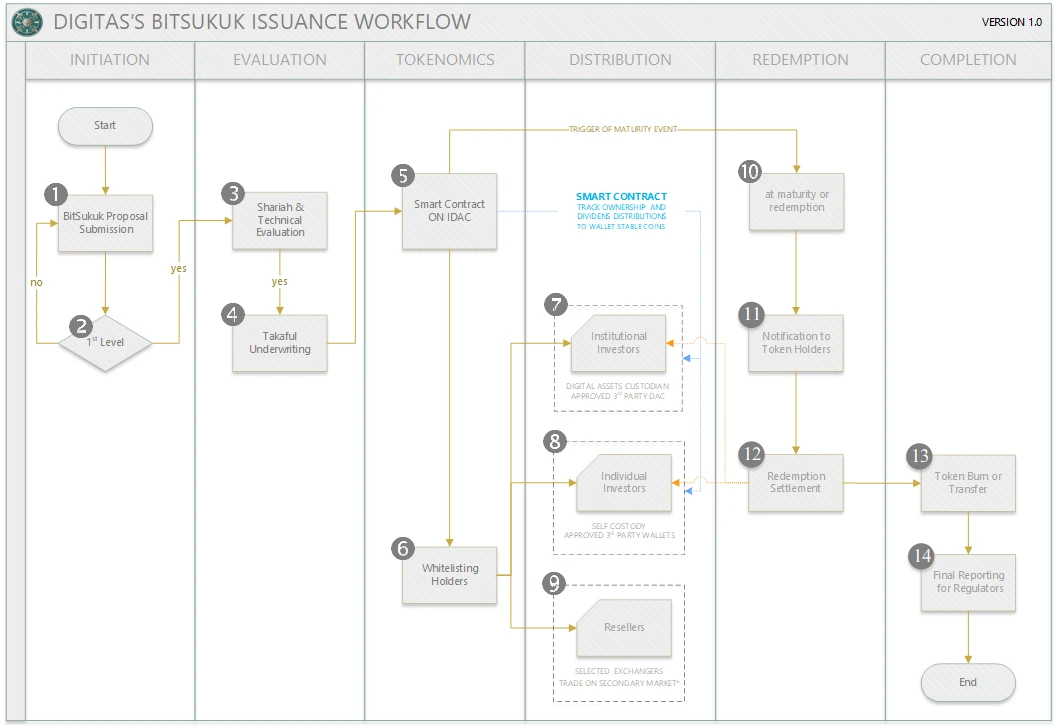

At the heart of this innovation lies a six-stage lifecycle that governs how every BitSukuk token is created, managed, and redeemed — ensuring Shariah integrity, investor protection, and institutional accountability at every step.

1. From Vision to Verification: The Proposal Stage

Each BitSukuk journey begins when a prospective issuer submits a project proposal through the BitSukuk platform. This includes detailed business plans, asset documentation, and proposed Sukuk structures. Before anything moves forward, an internal checkpoint review validates the project’s ethical alignment, document completeness, and compliance readiness. Only once it meets DIGITAS’ internal governance standards does it proceed to the next phase.

2. Shariah & Technical Evaluation: Dual Assurance

The second stage is where tradition meets due diligence.

Projects undergo a Shariah review by the Supervisory Board — verifying contract permissibility, asset ownership, and profit structures. Simultaneously, a technical and commercial assessment evaluates market feasibility and scalability.

This dual evaluation ensures that every project fulfills both religious and economic viability, establishing confidence before investors ever see it.

3. Takaful Underwriting: Protecting Faith and Finance

No Sukuk is truly complete without security for investors.

BitSukuk partners with Takaful providers to underwrite projects — offering principal protection that reinforces token credibility. This step aligns with Maqasid al-Shariah’s principle of wealth preservation, giving investors the assurance that their capital is ethically and structurally protected.

4. Smart Contract Deployment on IDACChain

Once approved, the Sukuk structure is translated into code.

A smart contract is deployed on the IDAC blockchain, automating the entire lifecycle: ownership tracking, profit distribution, and redemption logic.

Every line of code undergoes audit and verification — ensuring that Shariah compliance and cybersecurity go hand in hand. The result: a transparent, tamper-proof system where faith and technology coexist seamlessly.

5. Whitelisting and Token Distribution

Investor protection remains central to BitSukuk’s philosophy.

Only KYC/AML-verified wallets are eligible for token participation. Once approved, tokens are distributed to:

-

Institutional Investors through regulated digital custodians,

-

Individual Investors directly to their verified self-custody wallets, and

-

Approved Resellers/Exchangers to enhance liquidity on compliant exchanges.

This step ensures that participation remains inclusive yet strictly regulated — bridging access without compromising integrity.

6. Profit Distribution, Maturity, and Redemption

The life of a BitSukuk token mirrors traditional Sukuk — but automated and precise.

Profit distributions (dividends) are executed through smart contracts, sent directly to verified wallets at regular intervals. In cases of maturity or early redemption, the same contract governs principal repayment transparently on-chain.

Unclaimed dividends are redirected to a dedicated Waqf pool, turning unclaimed assets into ongoing charitable impact — a true embodiment of Islamic social finance principles.

7. The Final Chapter: Transparency and Shariah Closure

When redemption concludes, DIGITAS issues a Final Shariah Compliance Certificate, an Investor Statement Summary, and a Redemption Audit Report.

Every transaction, from issuance to settlement, remains traceable, immutable, and auditable — providing regulators, investors, and scholars complete confidence in the system.

This marks the completion of the BitSukuk lifecycle — a circular, ethical, and technologically advanced model of modern Islamic capital markets.

Pioneering the Future of Islamic Finance

BitSukuk is more than a product — it’s a blueprint for the next generation of digital Sukuk issuance. By embedding Shariah, governance, and technology into one cohesive framework, DIGITAS is redefining how capital can be raised, shared, and multiplied within the global Ummah.

In an era where inclusion, trust, and automation define progress, BitSukuk stands as proof that faith-based finance can lead the digital revolution — responsibly, transparently, and sustainably.

Comments: